Spanish

The relationship between the current depression and monopolies seems to elude analysts. I introduced "Monopoly Depression" in the Google searcher box and the only entries (a part of this blog ) refer to the game of Monopoly and som extrange mental derangement.

Not a single reference elsewhere. Shocking. I tried "Monopolistic Depression". In this case Monopoly game did not apear but google continue to insist in a rare variety of mental depression. No one single economic reference.Finally I tried "Monopolist Economic Depression" and in this case only six results, all referred to Exit Capitalism. More shocking still. Well, whether we like it or not, there is a very strong relationship that closely links the two phenomena.

Peter Thiel (Competition Is for Losers): "The opposite of perfect competition is monopoly. Whereas a competitive firm must sell at the market price, a monopoly owns its market, so it can set its own prices. Since it has no competition, it produces at the quantity and price combination that maximizes its profits....Actually, capitalism and competition are opposites. Capitalism is premised on the accumulation of capital, but under perfect competition, all profits get competed away...Only one thing can allow a business to transcend the daily brute struggle for survival: monopoly profits... Monopolists lie to protect themselves. They know that bragging about their great monopoly invites being audited, scrutinized and attacked. Since they very much want their monopoly profits to continue unmolested, they tend to do whatever they can to conceal their monopoly—usually by exaggerating the power of their (nonexistent) competition."

Depressions feel good to monopoly capital.

Brad DeLong: "At some point we must stop calling this" The Great Recession "and start calling it "The Great Depression" ".

The term "depression" causes chills and is forbidden in the media, but here and there, insistent timid warnings are arising that we have something much deeper and more dangerous than a long recession, some thing like a "secular stagnation" (the term would be borrowed from Keynesian economist Alvin Hansen who used it in the forties. Krugman defines it as "a persistent situation in which a depressed economy is the norm, punctuated with increasingly sporadic episodes of employment recovery ")

Chinese demand for raw materials, combined with speculation on the stock market and lax monetary policies, massive borrowing and massive rounds of debt monetization (Quantitative Easing) induced a temporary decoupling of raw materials exporting countries, and a brake on the overall demand downward trend, thanks to the increased demand of the BRICS. This stage is nearing completion. China will never replace the US or Europe as a global consumer locomotive, since the overall global monopoly structure excludes improving conditions for Chinese workers.

China has been trapped at the end of the chain of the international division of labor. He will never evolve as a new Japan or a new South Korea. If in the 90s it seemed that the bureaucracy controlled the process of opening up to capitalism, in the next decade multinational capital took definitive control of Chinese economy. Transnational and foreign capital controls the majority of the industrial sectors of the country (60% of all exports and 80% of exports of electronics and machinery sector). Most Chinese brands have succumbed one by one. Foreign companies not only control the export sector but are taking positions in the service sector (consulting, real estate, insurance, auditing, messaging, entertainment, refreshments, sport, supermarkets, etc.) and even in public services (water supply, sewerage, sanitation, education, ...).

After the 2009 economic and financial crisis, the huge public investment stimulus (thanks to the huge dollar reserves accumulated after years of trade surpluses with USA) has not resulted in a better distribution of income and wealth (domestic demand) but quite the contrary. China is the country with the highest inequality in the world (after Nepal). In addition, most of the new capacity has been installed in the export sector (subject to the multinational monopolies) counting on a strong recovery in global external demand. But the recovery in demand from the US, EU and Japan has been all but disappointing so China kept irrationally pulling and pulling, resulting in a massive overcapacity crisis aggravated by heavy debt that threatens to lead to a great financial crisis.

Global growth since the crash of 2008 has largely been driven by Asia and Latin America; Only Asia accounted for almost 60% of global growth in the period 2009-2014.

But growth in Asia prior to the 2008 financial crisis was driven by exports of large transnational corporations relocated there, the advanced capitalist countries, particularly the US.

However, as a result of this relocation (fewer jobs) demand from developed countries was falling persistently, thus, Asian countries saw their exports were plummeting. The following chart shows the growth of exports every year of Asian countries.

The inter-Asian trade (basically composed of parts and components) is also falling as shown in the following graph:

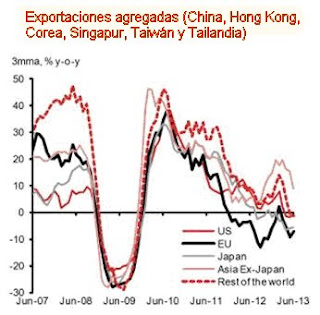

The figure below shows the aggregate exports (China, Hong Kong, Korea, Singapore, Taiwan and Thailand). Declines in exports to Japan and the EU are particularly striking.

The Wall Street Journal and the IMF itself recognized that this is an economic model (based exclusively on Asian exports to the West) that is failing everywhere.

Spending massive investment in China has helped support exports and intra-Asian trade. After the collapse of exports in 2009, Chinese authorities launched a huge investment program to keep pace with activity and wait for exports recovering . The problem is that exports dit not sufficiently recovered. The recovery in so-called emerging countries, Latin America and Africa, proffiting from exports to China, was not enough given the continuing fall in demand in the core countries. With the fall in demand, now global, China has an unparalleled problem of overcapacity.

But China is still in the same addiction (fearing uncontrollable riots?). Since February 2014, China has approved at least 2,300,000 million dollars in new infrastructure projects to counter the growing economic slowdown. But these infrastructures, apart from real white elephants, are not aimed at the needs of the domestic market but, as above, are aimed mostly at strengthening the export model (which requires low wages, resource depletion and environmental destruction), subject to the monopoly globalization.

Governments across the Asian regions have similar strategies and launched a blind competition among them to attract and retain business investment monopoly at the expense of keeping lower labor costs as possible.

Gillem Tulloch: "China is consuming more steel, iron and cement per capita than any other industrial nation in history. All railways will never make money, roads where no one drives or cities where no one lives. "

Another indicator of the overall fragility is the decline in prices of raw materials. Of course, this trend is largely a result of the above. The decline in exports from Asia has resulted in a decline in regional manufacturing activity and a drop in demand and in prices of most commodities (prices of copper, aluminum, platinum, oil, coal, iron, etc., are already close to 2009 levels and some have already fallen below)

These sharp declines in commodity prices threaten to drastically reduce growth rates of African and Latin American countries, most of which depend on exports of these commodities to finance imports needed to support the production and internal consumption, threatening to further reduce Chinese exports (the vicious cycle of depression).

Since the 2008 financial crisis the world has leveraged further. The total global public and private debt has increased from $ 143 trillion in 2007 to 200 trillion in 2014. The overall debt rose from 258% of world GDP in 2007 to 270% of it in 2014. The capitalist world never in its history has been so indebted.

While Europe has seen a transfer of private debt to public debt through bailouts, in China, the total debt, including the financial sector, has almost quadruplicated since 2007, reaching the equivalent of 282% of GDP.

Before the crisis of 2008, all European nations, apart from Portugal and Greece, were reducing their level of debt to GDP. Most of Europe was reducing public debt to manageable and historically very low levels. Irish debt, for example, was very low (27%). It seemed as if they were preparing for the subsequent massive bailout.

The next financial crisis is going to be definitely another debt crisis. But once started, however, the crisis will be very different from the last since this time almost all nations are already heavily in debt and unable to take on a new wave of rescues.

E.J. Jobsbawm (Industry and Empire): "During the Great Depression the standard of living of the workers who still have jobs are maintained thanks to the fall in the cost of life".

In the old cyclical crises of overproduction of the nineteenth century, it was strong competition between companies which depressed prices (deflation), less competitive companies went banckruptcy and the market soared from lower prices and fewer suppliers companies.

The current weakness of most economies, combined with the sharp fall in energy prices, has raised the fear of deflation for the first time since the Great Depression. In December 2014 the Eurozone fell back into deflation (there was deflation also in 2009). Japan is in deflation and the US and the UK are increasingly close to deflationary prices rates.

According to academic economists the problem of deflation (and expectations involved) it is that it is a spiral that feeds on itself. Deflation reduces the rate of corporate profits that in response lower wages even further, resulting in lower aggregate demand and a further back down of prices. Deflation means that the real value of families, businesses and public administrations debts increase, so that a slight rise in interest rates may lead all them to default or bankruptcy. In addition, widespread indebtedness retract state investment and household demand.

One problem with this theory is that it does not explain why the demand does not recover by lowering prices. In previous crises, with a less monopolized system, prices plummeted by lack of demand (deflation) and competition between companies. The disappearance of companies on the one hand and low prices on the other, ended finally with the overcapacity, unemployment and deflation of the crisis.

Another problem with this interpretation is that it considers a general deflation as something that affects all sectors, both monopolized and the rest. Although there are sectors where prices do not depress, but even go up, in computing the aggregate data dissapears the resisting prices and profits of the heavily monopolized sectors (banks, electricity, gas, water, gas stations, drug, food, drink, toll highways, telecommunications, etc.).

In the non-monopoly sector in crisis (houses for rent, bars, farmers, supliers, ...), who does not lower prices does not put their products or services on the market. In this case consumers are winners, and few of them are excluded. However in monopolized sectors, such as energy corporations, telecommunications, gas stations, privatized public services, etc., prices resist i even go up during the crisis and increase profits at the expense of customers who, in the absence of alternative suppliers, they can only choose between paying the bill or be excluded . Private monopolies can more than offset the drop in demand by raising their prices even if it means the exclusion and marginalization of many of the world's population.

Another hole in the conventional theory is that it assumes that overcapacity is bad for the economy and bad for everyone. But actually monopolist has some interest in maintaining overcapacity since this constitutes a good entry barrier in defense of their enclousured markets. Wal-Mart keeps operating in certain areas huge shopping centers, totally superfluous, to deter potential opponents.

Low interest rates and monetary helicopters (QE or massive purchase of bonds and debt by the Central Bank) in the US and now in the euro zone have not accomplished its supposed stimulating effect on investment. Large corporations, financial and non-financial, have captured this funds issuing bonds at bargain rates to invest in the stock markets.

The "easy" money currently provided by central banks, supposedly to restore growth, is easy money for big business but not, of course, for labor or small businesses. It does not stimulate investment but only the financial and speculative sector, increasing inequality and negative redistribution increasingly detracting resources from the poor to give to the rich.

One way to increase profits without investing in the real economy is to use the "stimuli" to buyback your own actions. Thus you achieves to lower the ratio beetwen dividents and the number of shares (the EPS - earnings per share - increased) ie, the rate of return of securities increases artificially attracting more investors to the stock exchange and so increasing quotations. Only a small residual portion of these "stimuli" is used to invest in new technologies or more jobs.

The green line with its scale data left, collects benefit payments to shareholders and shares buy-backs, while the red line, with its scale data on the right, collects funds for productive investment.

Repurchase operations announced for 2015 will register a record never reached of 993,000 million dollars. Since 2009, large American corporations have spent 2.4 trillion in repurchasing its own shares.

According to Bloomberg Businessweek, many analysts share the view that large corporations are forced to adopt this behavior due to, or lack of, more "attractive" alternatives (weak aggregate demand and negative expectations of profit) for the use of their funds.

In short, the outlook for growth in the core countries is poor and as a result, Asia faces the very exhaustion of its growth strategy driven by exports. And the same is true for sub-Saharan Africa and Latin America.

And the prospects for growth in the core countries are bleak given the austerity policies imposed by the Troika and the German and Japanese strategies of growth through exports (sacrificing domestic demand). As for the US, despite the fall in oil prices (which as elsewhere takes its own laps of time in lowering the price of gasoline), it is difficult that the exuberance of Wall Street and the stock markets will translate or mirrow into a "wealth effect "enough to stimulate demand, recovering its former role of locomotive of last resort for the global economy.

In conclusion, with no significant structural changes in most economies, changes that include policies to encourage improvements in the conditions of life and work and resolutely face the environmental disaster caused by monopoly neoliberalism, we are fully entering into a long period difficulties.

Shimshon Bichler and Jonathan Nitzan: " Economists generally agree that the share of capital income in total income of the advanced countries is procyclical, meaning that in times of economic boom and low unemployment their incomes increase more than proportionally . But this is not what happens in practice. According to data from the world war, the income share of capital has been counter-cyclical, rising and falling during crises during booms "..." In plain language: the capitalists are not at all concerned about the crisis but all otherwise. The love it."

Technocratic explanation: Unlike other depressions in the current situacion there are not enough technical innovations covering a wide area of economic sectors that can mean the creation of new industries and redirect the system in the path of growth.

Martin Wolf: "The world economy has been generating more savings that businesses want to use, even at very low interest rates"

For Keynesians, depression is the result of increased hoarding combined with a lack of investment demand. Much hoarding and lack of demand for loans for investment involves the famous liquidity trap: real interest rates low, even negative, fail to stimulate investment and growth.

Some unscrupulous suggest that the cause of hoarding would be the aging of population and the declining birth rate. Wolf, meanwhile, attributes the fall in investment to a change in the "corporate culture" that prefer to speculate in financial assets to invest in productive capital.

According to the classical Marxist theory, the phenomenon leading to depression is on the low rate of expected corporations profits from their funds.

Competition among capitalists force prices and therefore the rate of profit to fall, discouraging investment and creating unemployment.

But the problem with that view is that large monopoly corporations continue to provide ample profit rates even in times of depression. In modern times does not occur a falling rate of profit in the large monopolist sector but on the contrary.

Paul M. Sweezy and Paul. A. Baran, in his book "The Monopoly Capital" in 1966 argued that monopoly capital has a dynamic contradiction. Unlike under capitalism of small business in hard competition, in which there was a tendency to decrease the rate of profit, in the subsequent step, with the generalization of large monopolies, this trend disappears replaced by a growing profits rate, at least for the monopolized sector.

But, according to Baran and Sweezy the system displays a chronic inability to absorb the huge gains that can produce. Thanks to their monopoly positions they obtain gains in excess that they invest in additional capacity. The problem is that aggregate demand does not follow and productive capacity becomes overcapacity so that future investments will not generate more profits. Why increase investment if the benefits continue to flow with the current installed capacity? Ie, monopoly capitalism dies of its own success. "It follows that the normal state of the monopoly capitalist economy is stagnation".

And while financial speculation promise rates higher than the actual investment profits, the capitalists will run out from productive investment. Speculative financialization, although it can generate more business via financial bubbles due to the wealth effect associated with them, eventually generates more inequality and therefore lower effective demand.

In what seems all agree is on that the Great Depression do not interest to their sufferers (workers and middle classes) but also do not interest all capitalists (the Keynesians particularly insist on it) and at this point they are wrong. There is a group of capitalists, the most powerful, who may be interested in depression. This is the big transnational monopoly corporation.

To create a simple job means an effort in fixed capital (organic composition of capital) that few investors are actually willing to cash. But with no additional jobs unemployement force wages down. This keeps increasings the profits of the monopolized industries (monopoly rents) but shrinks more and more global demand (vicious circle).

We have to consider two distinct segments with respect to the rate of profit. We must dissagregate the profits of monopoly sector from profits of non-monopoly sector.

The investment in the non-monopoly sector reacts directly to the profit rate, present and expected. However, the reaction in the monopoly sector to the rate of profits is by no means directly proportional. There may not be any reaction at all or may even be an inverse relationship. At more profits less investment.

Monopoly capital resist very well great periods of crisis. You may notice that, paradoxically, they rather thrive when the non monopolist sector go down. Their share of total income increases countercyclical. A more depression greater inequality since the proportion of income they appropriate encrease. The tremendous increase in inequality as depression extends and deepens reflects this paradox.

The explanation for this apparent paradox is the result of the mad competition in non-monopoly sector (suppliers, subcontractors, workers, etc) involving the fall in prices, rents and profits (deflation), all that resulting in lower costs for the monopoly sector and therefore increasing their monopoly rents. This means that the fall in rents and profits of some, the most, increases the profits and rents of monopoly minority.

With the crisis and depression the only ones who keep their profits are corporations with greater degree of monopoly. Profit rates of big monopolistic corporations have doubled since 2008 due to reduced corporate tax, reduced employer contributions to social security and shrinking wages (policies of austerity and internal devaluation), while the rate of profits of non-monopoly sector collapses dragged by the decline of global demand.

Really no one knows how much are the profits of multinational corporations. They declare what they want where they want. Its profits statements are part of its "creative accounting" to attract new capital or are simply part of their public relations policy. Hence the persistent asymmetry whereby profits appear only on the good side of the value chain that is usually located in a tax haven.

Multinational monopolies, basically use three techniques to disguise their profits and evade taxes

a) Moving "their" intellectual property (patents, trademarks, ...) to subsidiaries in tax havens. Subsidiaries located in tax havens do not pay (deductible expenses) for patents "owned" by the subsidiary of a tax haven.

b) Transfer pricing. All subsidiaries in countries where taxes must be paid do not record any profit since commodities go in at similar costs that the sales prices charged to end consumers . In the process of production, transportation and marketing are involved several subsidiaries that bill between them. The only subsidiaries that record profits are these registered in tax havens.

c) Profit stripping is to offset profits in a country where you pay taxes with expenses payable to a subsidiary in a tax haven. A subsidiary in Bermuda lend money at interest to a subsidiary in France. The profits in France are kept down to pay interest to the subsidiary in Bermuda.

Another advantage of depression for large corporations is that the contraction of demand generated overcapacity in the most affected sectors; but for the monopolists, overcapacity is an additional barrier to entry which strengthen their positions and favors expansion. Overcapacity becomes an intrinsic, desired and permanent feature of the monopoly Depression.

Under deflation and overcapacity non-monopolistic businesses close and throw the towel, while central banks send up fleets of monetary helicopters that invariably end up in financial speculation, providing more and more powder for the concentration of capital. As in previous depressions, the crisis is the breeding ground for monopoly concentration and as can be seen, the day-to-day crisis do not stop mergers, associations, acquisitions, ... a race without obstacles to the Global monopolism.

Indebted states, opting for austerity and internal devaluation soon are forced to give up companies, services and public monopolies, which are immediately absorbed by the jaws open wide of capital concentration.

Thus, the monopoly would fatten with Great Depression. The Great Depression is good for the monopolists provided no sufficiently significant protests occur to threaten your system.

Financialization and speculative financial bubbles are inherent to monopoly capitalism.

The growing monopolists surplus that do not find placement in the real economy are diverted toward financial speculation increasingly generating more huge bubbles. A defining characteristic of the current phase of global monopoly capital 2.0 is the rising and growing of spiral financial bubbles that are dotting the geography of the last stages of the Great Depression.

Bubbles act as a drug addiction. The absorption of a new dose seems to improve the feelings of the subject whose health is deteriorating with the rapid succession of increasingly stronger doses. But bubbles benefit monopoly capital since, thanks to its privileged information usually leave on time and unscathed from speculative successive rounds. Just in case, the size of corporations is such (too big to fail) that have assured the public rescue in case of bankruptcy.

Public bailouts increase the indebtedness of states which are constrained to sell off public assets (public monopolies, utilities, etc.), which further increases the concentration of monopoly capital.

The increase in public debt, facilitates labor and administrative "flexi-reforms" that contribute to further increase the monopoly rent and therefore the the next bubble speculation.

But if all that were not enough, after bubbles major central banks launche monetary helicopters fleets (Quantitative Easing) to monetize debt, money that also ends in the hands of speculators inflating the next bubble further.

Hayek: "The ideal result would be the transformation of local governments and even of regional governments to quasi commercial corporations competing to attract investors".

The global monopolist expansion requires, almost as a sine qua non, the freedom of movement of capital. That there is no such freedom for individuals may even be advantageous for big capital since the division and discrimination between workers provides higher rates of labor exploitation (labor arbitrage).

Freedom of capital flows, while ensuring tax evasion, repatriation of profits and financial speculation, facilitates the ability of transnational monopolies for offshoring and relocating, thus achieving, despite nationalist obstacles to labor movements, the much desired reduction in labor costs in Western countries, in addition to considerable tax advantages and public subsidies.

Hence the leitmotive of monopoly neoliberal capitalism discurse are the supposedly unquestionable benefits (sic!) Of the free movement of capital, free movement that brings more monopoly, more dependency, more poverty and more depression.

The international mobility of capital (through liberalized financial markets and free trade) potentiates a disciplinary effect on states. Capital mobility requires states to compete for mobile transnational capital, providing the kind of neoliberal policies that investors and multinational companies demand.

The mobility of capital, based on the "right to leave" creates a kind of "government policies market" in which firms claim to be located in jurisdictions that offer the most favorable mix of labor costs, environmental costs, taxes and services. That is, the mobility of capital globalizes the neoliberal austerity policies of impoverishment and carries a withdrawal of aggregate demand which translates into more depression.

During the Great Depression of the thirties nations tried to decouple from depression taking a variety more or less sound economic policies.

But actually monopoly capital is provided with a formidable theoretical arsenal to ensure their dominance and prevent any lasting and effective decoupling of its Monopolistic Depression.

The theory of the "impossible trinity" has been used to justify anti-democratic consequences of offshoring and capital flows associated with monopoly neoliberal globalization, constituting the main theoretical trick to force permanent "opening" of economies to transnational capital.

The "impossible trinity" or "trilemma" said, according to the 1962 Mundell-Fleming model, that is impossible for a country to simultaneously maintain a fixed exchange rate, free capital flows and a separate and independent monetary policy.

According to the famous theory, governments of "open" economies face an economic "trilemma" that "forces to resign" at least to one objective of economic policy. If they want to "enjoy" free flow of capital (1), they must sacrifice the exchange rate policy of its currency (2) or give up to its own monetary policy (3). Ie they will only enjoy an autonomous monetary policy if they let the exchange rate float.

That is, to give up a political control over the movements of transnational capital (open economy) implies, "for reasons of economic theory", to give up an autonomous exchange rates policy (currency devaluation for exemple ) or an independent monetary policy (lower interest rates). The give up of a certain economic policy for the benefit of the population would not be at all a cut of national democracy but a whimsical imponderable of economic theory.

In practice, as has recently statetdhe economist Hélène Rey, the global financial cycle restricts monetary policies whatever the exchange rate regime. "Many believe that a flexible exchange rate can isolate ourselves from financial shocks and allow us to pursue an independent monetary policy ... But if there is a global financial cycle, as I think, the exchange rate can not separate us from what happens in the rest countries "(Finance and Development. June 2015). That is, if you want to continue "enjoying" the free flow of capital, so dear to monopoly transnational capital, you will have to give up any autonomous economic policy at all. That is, the free flow of transnational monopoly capital imposes a kind of straitjacket that prevents any democratic reaction to Monopolistic Depression.

In addition, monopolists and financiers have imposed on the world a kind of "solidarity market". In the absence of capital controls and trade protectionism, and with most industries offshored , economic stimulus in some countries end up benefiting exports of others. In the Chinese case the beneficiaries have been Latin America and sub-Saharan Africa, the so-called emerging countries that managed to decouple for a few years of the Monopolistic Depression.

It is precisely the quasi constitutional institutionalization of free mobility of transnational capital registered in bilateral agreements, regional agreements, integration agreements, or macro global agreements (TTIP, TPP), which is preventing the nations to resist the onslaught of the Great Monopolistic Depression.

Even the giant Chinese nation, with huge dollar reserves, is experiencing that to continue "enjoying the free flow of capital" implies few if any autonomy in terms of policy exchange or alternative monetary policy to boost domestic demand. China will must, therefore, die insisting on the export model that will dictate transnational monopolies, polluting without restraint, squandering its resources, cutting wages and increasing the number of unemployed.

So triumphant monopoly capitalism, with little opposition can finally show his true face, its intrinsic essence is to maintain human society in a permanent state of economic and environmental crisis to further increase their power and profits at any cost even if it means ending the human experience on the planet.

Links:

http://blogs.lclark.edu/hart-landsberg/2015/07/26/capitalism-at-work-profits-over-people/

http://blogs.lclark.edu/hart-landsberg/2015/08/03/signs-of-global-slowdown/

http://isj.org.uk/the-global-crawl-continues/

The relationship between the current depression and monopolies seems to elude analysts. I introduced "Monopoly Depression" in the Google searcher box and the only entries (a part of this blog ) refer to the game of Monopoly and som extrange mental derangement.

Not a single reference elsewhere. Shocking. I tried "Monopolistic Depression". In this case Monopoly game did not apear but google continue to insist in a rare variety of mental depression. No one single economic reference.Finally I tried "Monopolist Economic Depression" and in this case only six results, all referred to Exit Capitalism. More shocking still. Well, whether we like it or not, there is a very strong relationship that closely links the two phenomena.

Peter Thiel (Competition Is for Losers): "The opposite of perfect competition is monopoly. Whereas a competitive firm must sell at the market price, a monopoly owns its market, so it can set its own prices. Since it has no competition, it produces at the quantity and price combination that maximizes its profits....Actually, capitalism and competition are opposites. Capitalism is premised on the accumulation of capital, but under perfect competition, all profits get competed away...Only one thing can allow a business to transcend the daily brute struggle for survival: monopoly profits... Monopolists lie to protect themselves. They know that bragging about their great monopoly invites being audited, scrutinized and attacked. Since they very much want their monopoly profits to continue unmolested, they tend to do whatever they can to conceal their monopoly—usually by exaggerating the power of their (nonexistent) competition."

Depressions feel good to monopoly capital.

- With depression monopolists gain market share at the expense of non-monopoly sector.

- With depression the profits of monopoly sectors remain and even increase because only monopolists can maintain and even increase their prices in Depression.

- According to the shock doctrine (Naomi Klein), monopoly capital take advantage of disasters. In the shock and confusion generated by Depression monopolist take advantage to introduce neoliberal regulations to ensure their businesses and their monopoly rents.

- Depression creates substantial opportunities for capitalist concentration: state borrowing difficulties facilitates the privatization of public enterprises and public services.

- The crazy competition caused by the economic depression in non-monopoly industry (suppliers, subcontractors, workers, etc) implies the fall in prices, rents and profits (deflation), lowering costs for the monopoly sector and therefore increasing their monopoly rents. This means that the fall in rents and profits of some, the majority, increases the proffits of the minority, the monopolists. Monopoly sector increases its share of global income at the expense of the income of everyone else.

- Depression means redistribution of rent and wealth in favour of the wealthiest. But this redistribution means proletarization. Monopoly capital is the true esence of capitalism and the perfect machine of total apropiation or destruction of the means of production still not in their hands. Monopolistic depression means proletarization at a great scale.

- Depression can be dangerous for monopoly capital if the people or the states react against their interests (economic nationalism, controls on capital movements, renationalisation, socialization, anti-trust regulations, etc.) Hence its diligence introducing regulations (bilateral free trade treaties, the Treaty of Maastricht, NAFTA, TTIP, TPP, etc.) to ensure perpetual depression and constitutionalising inability of democratic people and states to react in front of monopoly depression. The TTIP, TPP, and the like, constitutionalize the Monopolist Depression.

- In 2011 I published an article entitled "Phase 4, Permanent Depression", where I promised the delivery of Chapter III, once finalized Chinese econòmic "miracle". Now that the Chinese econòmic "miracle" is up we are entering Chapter III of the Great Monopolistic Depression of XXIth century..

I- The end of the disengagement of emerging countries

Brad DeLong: "At some point we must stop calling this" The Great Recession "and start calling it "The Great Depression" ".

The term "depression" causes chills and is forbidden in the media, but here and there, insistent timid warnings are arising that we have something much deeper and more dangerous than a long recession, some thing like a "secular stagnation" (the term would be borrowed from Keynesian economist Alvin Hansen who used it in the forties. Krugman defines it as "a persistent situation in which a depressed economy is the norm, punctuated with increasingly sporadic episodes of employment recovery ")

1.Chinese decoupling

Chinese demand for raw materials, combined with speculation on the stock market and lax monetary policies, massive borrowing and massive rounds of debt monetization (Quantitative Easing) induced a temporary decoupling of raw materials exporting countries, and a brake on the overall demand downward trend, thanks to the increased demand of the BRICS. This stage is nearing completion. China will never replace the US or Europe as a global consumer locomotive, since the overall global monopoly structure excludes improving conditions for Chinese workers.

China has been trapped at the end of the chain of the international division of labor. He will never evolve as a new Japan or a new South Korea. If in the 90s it seemed that the bureaucracy controlled the process of opening up to capitalism, in the next decade multinational capital took definitive control of Chinese economy. Transnational and foreign capital controls the majority of the industrial sectors of the country (60% of all exports and 80% of exports of electronics and machinery sector). Most Chinese brands have succumbed one by one. Foreign companies not only control the export sector but are taking positions in the service sector (consulting, real estate, insurance, auditing, messaging, entertainment, refreshments, sport, supermarkets, etc.) and even in public services (water supply, sewerage, sanitation, education, ...).

After the 2009 economic and financial crisis, the huge public investment stimulus (thanks to the huge dollar reserves accumulated after years of trade surpluses with USA) has not resulted in a better distribution of income and wealth (domestic demand) but quite the contrary. China is the country with the highest inequality in the world (after Nepal). In addition, most of the new capacity has been installed in the export sector (subject to the multinational monopolies) counting on a strong recovery in global external demand. But the recovery in demand from the US, EU and Japan has been all but disappointing so China kept irrationally pulling and pulling, resulting in a massive overcapacity crisis aggravated by heavy debt that threatens to lead to a great financial crisis.

2. Export crisis

Global growth since the crash of 2008 has largely been driven by Asia and Latin America; Only Asia accounted for almost 60% of global growth in the period 2009-2014.

But growth in Asia prior to the 2008 financial crisis was driven by exports of large transnational corporations relocated there, the advanced capitalist countries, particularly the US.

However, as a result of this relocation (fewer jobs) demand from developed countries was falling persistently, thus, Asian countries saw their exports were plummeting. The following chart shows the growth of exports every year of Asian countries.

The inter-Asian trade (basically composed of parts and components) is also falling as shown in the following graph:

The figure below shows the aggregate exports (China, Hong Kong, Korea, Singapore, Taiwan and Thailand). Declines in exports to Japan and the EU are particularly striking.

The Wall Street Journal and the IMF itself recognized that this is an economic model (based exclusively on Asian exports to the West) that is failing everywhere.

Spending massive investment in China has helped support exports and intra-Asian trade. After the collapse of exports in 2009, Chinese authorities launched a huge investment program to keep pace with activity and wait for exports recovering . The problem is that exports dit not sufficiently recovered. The recovery in so-called emerging countries, Latin America and Africa, proffiting from exports to China, was not enough given the continuing fall in demand in the core countries. With the fall in demand, now global, China has an unparalleled problem of overcapacity.

But China is still in the same addiction (fearing uncontrollable riots?). Since February 2014, China has approved at least 2,300,000 million dollars in new infrastructure projects to counter the growing economic slowdown. But these infrastructures, apart from real white elephants, are not aimed at the needs of the domestic market but, as above, are aimed mostly at strengthening the export model (which requires low wages, resource depletion and environmental destruction), subject to the monopoly globalization.

Governments across the Asian regions have similar strategies and launched a blind competition among them to attract and retain business investment monopoly at the expense of keeping lower labor costs as possible.

3. Fall in the price of raw materials

Gillem Tulloch: "China is consuming more steel, iron and cement per capita than any other industrial nation in history. All railways will never make money, roads where no one drives or cities where no one lives. "

Another indicator of the overall fragility is the decline in prices of raw materials. Of course, this trend is largely a result of the above. The decline in exports from Asia has resulted in a decline in regional manufacturing activity and a drop in demand and in prices of most commodities (prices of copper, aluminum, platinum, oil, coal, iron, etc., are already close to 2009 levels and some have already fallen below)

These sharp declines in commodity prices threaten to drastically reduce growth rates of African and Latin American countries, most of which depend on exports of these commodities to finance imports needed to support the production and internal consumption, threatening to further reduce Chinese exports (the vicious cycle of depression).

4. Rising debt

Since the 2008 financial crisis the world has leveraged further. The total global public and private debt has increased from $ 143 trillion in 2007 to 200 trillion in 2014. The overall debt rose from 258% of world GDP in 2007 to 270% of it in 2014. The capitalist world never in its history has been so indebted.

While Europe has seen a transfer of private debt to public debt through bailouts, in China, the total debt, including the financial sector, has almost quadruplicated since 2007, reaching the equivalent of 282% of GDP.

Before the crisis of 2008, all European nations, apart from Portugal and Greece, were reducing their level of debt to GDP. Most of Europe was reducing public debt to manageable and historically very low levels. Irish debt, for example, was very low (27%). It seemed as if they were preparing for the subsequent massive bailout.

The next financial crisis is going to be definitely another debt crisis. But once started, however, the crisis will be very different from the last since this time almost all nations are already heavily in debt and unable to take on a new wave of rescues.

5. Deflation in the non-monopoly sector

E.J. Jobsbawm (Industry and Empire): "During the Great Depression the standard of living of the workers who still have jobs are maintained thanks to the fall in the cost of life".

In the old cyclical crises of overproduction of the nineteenth century, it was strong competition between companies which depressed prices (deflation), less competitive companies went banckruptcy and the market soared from lower prices and fewer suppliers companies.

The current weakness of most economies, combined with the sharp fall in energy prices, has raised the fear of deflation for the first time since the Great Depression. In December 2014 the Eurozone fell back into deflation (there was deflation also in 2009). Japan is in deflation and the US and the UK are increasingly close to deflationary prices rates.

According to academic economists the problem of deflation (and expectations involved) it is that it is a spiral that feeds on itself. Deflation reduces the rate of corporate profits that in response lower wages even further, resulting in lower aggregate demand and a further back down of prices. Deflation means that the real value of families, businesses and public administrations debts increase, so that a slight rise in interest rates may lead all them to default or bankruptcy. In addition, widespread indebtedness retract state investment and household demand.

One problem with this theory is that it does not explain why the demand does not recover by lowering prices. In previous crises, with a less monopolized system, prices plummeted by lack of demand (deflation) and competition between companies. The disappearance of companies on the one hand and low prices on the other, ended finally with the overcapacity, unemployment and deflation of the crisis.

Another problem with this interpretation is that it considers a general deflation as something that affects all sectors, both monopolized and the rest. Although there are sectors where prices do not depress, but even go up, in computing the aggregate data dissapears the resisting prices and profits of the heavily monopolized sectors (banks, electricity, gas, water, gas stations, drug, food, drink, toll highways, telecommunications, etc.).

In the non-monopoly sector in crisis (houses for rent, bars, farmers, supliers, ...), who does not lower prices does not put their products or services on the market. In this case consumers are winners, and few of them are excluded. However in monopolized sectors, such as energy corporations, telecommunications, gas stations, privatized public services, etc., prices resist i even go up during the crisis and increase profits at the expense of customers who, in the absence of alternative suppliers, they can only choose between paying the bill or be excluded . Private monopolies can more than offset the drop in demand by raising their prices even if it means the exclusion and marginalization of many of the world's population.

Another hole in the conventional theory is that it assumes that overcapacity is bad for the economy and bad for everyone. But actually monopolist has some interest in maintaining overcapacity since this constitutes a good entry barrier in defense of their enclousured markets. Wal-Mart keeps operating in certain areas huge shopping centers, totally superfluous, to deter potential opponents.

6. More financialization

Low interest rates and monetary helicopters (QE or massive purchase of bonds and debt by the Central Bank) in the US and now in the euro zone have not accomplished its supposed stimulating effect on investment. Large corporations, financial and non-financial, have captured this funds issuing bonds at bargain rates to invest in the stock markets.

The "easy" money currently provided by central banks, supposedly to restore growth, is easy money for big business but not, of course, for labor or small businesses. It does not stimulate investment but only the financial and speculative sector, increasing inequality and negative redistribution increasingly detracting resources from the poor to give to the rich.

One way to increase profits without investing in the real economy is to use the "stimuli" to buyback your own actions. Thus you achieves to lower the ratio beetwen dividents and the number of shares (the EPS - earnings per share - increased) ie, the rate of return of securities increases artificially attracting more investors to the stock exchange and so increasing quotations. Only a small residual portion of these "stimuli" is used to invest in new technologies or more jobs.

The green line with its scale data left, collects benefit payments to shareholders and shares buy-backs, while the red line, with its scale data on the right, collects funds for productive investment.

Repurchase operations announced for 2015 will register a record never reached of 993,000 million dollars. Since 2009, large American corporations have spent 2.4 trillion in repurchasing its own shares.

According to Bloomberg Businessweek, many analysts share the view that large corporations are forced to adopt this behavior due to, or lack of, more "attractive" alternatives (weak aggregate demand and negative expectations of profit) for the use of their funds.

7. Dismal prospects of growth

In short, the outlook for growth in the core countries is poor and as a result, Asia faces the very exhaustion of its growth strategy driven by exports. And the same is true for sub-Saharan Africa and Latin America.

And the prospects for growth in the core countries are bleak given the austerity policies imposed by the Troika and the German and Japanese strategies of growth through exports (sacrificing domestic demand). As for the US, despite the fall in oil prices (which as elsewhere takes its own laps of time in lowering the price of gasoline), it is difficult that the exuberance of Wall Street and the stock markets will translate or mirrow into a "wealth effect "enough to stimulate demand, recovering its former role of locomotive of last resort for the global economy.

In conclusion, with no significant structural changes in most economies, changes that include policies to encourage improvements in the conditions of life and work and resolutely face the environmental disaster caused by monopoly neoliberalism, we are fully entering into a long period difficulties.

II. Depression favors Monopoly

Shimshon Bichler and Jonathan Nitzan: "

- With depressionMonopolists gain market share at the expense of non-monopoly sector.

- With depression the profits of monopoly sectors remain and even increase while monopolists are able to maintain and even increase their prices in the mids of depression.

- According to the doctrine of shock (Naomi Klein), monopoly capital take advantage of disasters. The shock and confusion generated by the Monopolistic Depression make easy to introduce neoliberal regulations to ensure their businesses and their monopoly rents.

- Depression means redistribution of rent and wealth in favour of the wealthiest. But this redistribution means proletarization. Monopoly capital is the true esence of capitalism and the perfect machine of total apropiation or destruction of the means of production still not in their hands. Monopolistic depression means proletarization at a great scale.

- The Monopolist Depression creates substantial opportunities for capitalist concentration: unbearable state borrowing facilitates the privatization of public enterprises and public services.

- With depression, crazy competition in non-monopoly industry (suppliers, subcontractors, workers, etc) implies the fall in prices, rents and profits (deflation), these fall resulting in lower costs to the monopoly sector and therefore increasing their monopoly rents. This means that the fall in rents and profits of some, the most, increases the benefits of monopoly minority. Monopoly sector increases its share of global income at the expense of the reduced income of everyone else.

- But depression can be dangerous for monopoly capital if the people or the states react against their interests (economic nationalism, controls on capital movements, renationalisation, socialization, anti-trust regulations, etc. something that occurred during the first Globalization) Hence the earnestness in introducing regulations (bilateral free trade treaties, the Treaty of Maastricht, NAFTA, TTIP, TPP, etc.) to ensure perpetual depression, constitutionalising democratic inability of states to react to Monopolistic Depression. The TTIP, TPP and the like, constitutionalize the Monopolistic Depression.

1. Theories about depression

Supply side theories of depression:

Technocratic explanation: Unlike other depressions in the current situacion there are not enough technical innovations covering a wide area of economic sectors that can mean the creation of new industries and redirect the system in the path of growth.

Demand side theories of depression (Keynesian):

Martin Wolf: "The world economy has been generating more savings that businesses want to use, even at very low interest rates"

For Keynesians, depression is the result of increased hoarding combined with a lack of investment demand. Much hoarding and lack of demand for loans for investment involves the famous liquidity trap: real interest rates low, even negative, fail to stimulate investment and growth.

Some unscrupulous suggest that the cause of hoarding would be the aging of population and the declining birth rate. Wolf, meanwhile, attributes the fall in investment to a change in the "corporate culture" that prefer to speculate in financial assets to invest in productive capital.

.Marxist theories

According to the classical Marxist theory, the phenomenon leading to depression is on the low rate of expected corporations profits from their funds.

Competition among capitalists force prices and therefore the rate of profit to fall, discouraging investment and creating unemployment.

But the problem with that view is that large monopoly corporations continue to provide ample profit rates even in times of depression. In modern times does not occur a falling rate of profit in the large monopolist sector but on the contrary.

Paul M. Sweezy and Paul. A. Baran, in his book "The Monopoly Capital" in 1966 argued that monopoly capital has a dynamic contradiction. Unlike under capitalism of small business in hard competition, in which there was a tendency to decrease the rate of profit, in the subsequent step, with the generalization of large monopolies, this trend disappears replaced by a growing profits rate, at least for the monopolized sector.

But, according to Baran and Sweezy the system displays a chronic inability to absorb the huge gains that can produce. Thanks to their monopoly positions they obtain gains in excess that they invest in additional capacity. The problem is that aggregate demand does not follow and productive capacity becomes overcapacity so that future investments will not generate more profits. Why increase investment if the benefits continue to flow with the current installed capacity? Ie, monopoly capitalism dies of its own success. "It follows that the normal state of the monopoly capitalist economy is stagnation".

And while financial speculation promise rates higher than the actual investment profits, the capitalists will run out from productive investment. Speculative financialization, although it can generate more business via financial bubbles due to the wealth effect associated with them, eventually generates more inequality and therefore lower effective demand.

In what seems all agree is on that the Great Depression do not interest to their sufferers (workers and middle classes) but also do not interest all capitalists (the Keynesians particularly insist on it) and at this point they are wrong. There is a group of capitalists, the most powerful, who may be interested in depression. This is the big transnational monopoly corporation.

2 Depression. Profits and proletarisation

To create a simple job means an effort in fixed capital (organic composition of capital) that few investors are actually willing to cash. But with no additional jobs unemployement force wages down. This keeps increasings the profits of the monopolized industries (monopoly rents) but shrinks more and more global demand (vicious circle).

We have to consider two distinct segments with respect to the rate of profit. We must dissagregate the profits of monopoly sector from profits of non-monopoly sector.

The investment in the non-monopoly sector reacts directly to the profit rate, present and expected. However, the reaction in the monopoly sector to the rate of profits is by no means directly proportional. There may not be any reaction at all or may even be an inverse relationship. At more profits less investment.

Monopoly capital resist very well great periods of crisis. You may notice that, paradoxically, they rather thrive when the non monopolist sector go down. Their share of total income increases countercyclical. A more depression greater inequality since the proportion of income they appropriate encrease. The tremendous increase in inequality as depression extends and deepens reflects this paradox.

The explanation for this apparent paradox is the result of the mad competition in non-monopoly sector (suppliers, subcontractors, workers, etc) involving the fall in prices, rents and profits (deflation), all that resulting in lower costs for the monopoly sector and therefore increasing their monopoly rents. This means that the fall in rents and profits of some, the most, increases the profits and rents of monopoly minority.

With the crisis and depression the only ones who keep their profits are corporations with greater degree of monopoly. Profit rates of big monopolistic corporations have doubled since 2008 due to reduced corporate tax, reduced employer contributions to social security and shrinking wages (policies of austerity and internal devaluation), while the rate of profits of non-monopoly sector collapses dragged by the decline of global demand.

Really no one knows how much are the profits of multinational corporations. They declare what they want where they want. Its profits statements are part of its "creative accounting" to attract new capital or are simply part of their public relations policy. Hence the persistent asymmetry whereby profits appear only on the good side of the value chain that is usually located in a tax haven.

Multinational monopolies, basically use three techniques to disguise their profits and evade taxes

a) Moving "their" intellectual property (patents, trademarks, ...) to subsidiaries in tax havens. Subsidiaries located in tax havens do not pay (deductible expenses) for patents "owned" by the subsidiary of a tax haven.

b) Transfer pricing. All subsidiaries in countries where taxes must be paid do not record any profit since commodities go in at similar costs that the sales prices charged to end consumers . In the process of production, transportation and marketing are involved several subsidiaries that bill between them. The only subsidiaries that record profits are these registered in tax havens.

c) Profit stripping is to offset profits in a country where you pay taxes with expenses payable to a subsidiary in a tax haven. A subsidiary in Bermuda lend money at interest to a subsidiary in France. The profits in France are kept down to pay interest to the subsidiary in Bermuda.

Another advantage of depression for large corporations is that the contraction of demand generated overcapacity in the most affected sectors; but for the monopolists, overcapacity is an additional barrier to entry which strengthen their positions and favors expansion. Overcapacity becomes an intrinsic, desired and permanent feature of the monopoly Depression.

Under deflation and overcapacity non-monopolistic businesses close and throw the towel, while central banks send up fleets of monetary helicopters that invariably end up in financial speculation, providing more and more powder for the concentration of capital. As in previous depressions, the crisis is the breeding ground for monopoly concentration and as can be seen, the day-to-day crisis do not stop mergers, associations, acquisitions, ... a race without obstacles to the Global monopolism.

Indebted states, opting for austerity and internal devaluation soon are forced to give up companies, services and public monopolies, which are immediately absorbed by the jaws open wide of capital concentration.

Thus, the monopoly would fatten with Great Depression. The Great Depression is good for the monopolists provided no sufficiently significant protests occur to threaten your system.

Depression and financial bubbles

Financialization and speculative financial bubbles are inherent to monopoly capitalism.

The growing monopolists surplus that do not find placement in the real economy are diverted toward financial speculation increasingly generating more huge bubbles. A defining characteristic of the current phase of global monopoly capital 2.0 is the rising and growing of spiral financial bubbles that are dotting the geography of the last stages of the Great Depression.

Bubbles act as a drug addiction. The absorption of a new dose seems to improve the feelings of the subject whose health is deteriorating with the rapid succession of increasingly stronger doses. But bubbles benefit monopoly capital since, thanks to its privileged information usually leave on time and unscathed from speculative successive rounds. Just in case, the size of corporations is such (too big to fail) that have assured the public rescue in case of bankruptcy.

Public bailouts increase the indebtedness of states which are constrained to sell off public assets (public monopolies, utilities, etc.), which further increases the concentration of monopoly capital.

The increase in public debt, facilitates labor and administrative "flexi-reforms" that contribute to further increase the monopoly rent and therefore the the next bubble speculation.

But if all that were not enough, after bubbles major central banks launche monetary helicopters fleets (Quantitative Easing) to monetize debt, money that also ends in the hands of speculators inflating the next bubble further.

4. Capital mobility and depression

Hayek: "The ideal result would be the transformation of local governments and even of regional governments to quasi commercial corporations competing to attract investors".

The global monopolist expansion requires, almost as a sine qua non, the freedom of movement of capital. That there is no such freedom for individuals may even be advantageous for big capital since the division and discrimination between workers provides higher rates of labor exploitation (labor arbitrage).

Freedom of capital flows, while ensuring tax evasion, repatriation of profits and financial speculation, facilitates the ability of transnational monopolies for offshoring and relocating, thus achieving, despite nationalist obstacles to labor movements, the much desired reduction in labor costs in Western countries, in addition to considerable tax advantages and public subsidies.

Hence the leitmotive of monopoly neoliberal capitalism discurse are the supposedly unquestionable benefits (sic!) Of the free movement of capital, free movement that brings more monopoly, more dependency, more poverty and more depression.

The international mobility of capital (through liberalized financial markets and free trade) potentiates a disciplinary effect on states. Capital mobility requires states to compete for mobile transnational capital, providing the kind of neoliberal policies that investors and multinational companies demand.

The mobility of capital, based on the "right to leave" creates a kind of "government policies market" in which firms claim to be located in jurisdictions that offer the most favorable mix of labor costs, environmental costs, taxes and services. That is, the mobility of capital globalizes the neoliberal austerity policies of impoverishment and carries a withdrawal of aggregate demand which translates into more depression.

5. The theory of the "impossible trinity" and the impossibility of decoupling

During the Great Depression of the thirties nations tried to decouple from depression taking a variety more or less sound economic policies.

But actually monopoly capital is provided with a formidable theoretical arsenal to ensure their dominance and prevent any lasting and effective decoupling of its Monopolistic Depression.

The theory of the "impossible trinity" has been used to justify anti-democratic consequences of offshoring and capital flows associated with monopoly neoliberal globalization, constituting the main theoretical trick to force permanent "opening" of economies to transnational capital.

The "impossible trinity" or "trilemma" said, according to the 1962 Mundell-Fleming model, that is impossible for a country to simultaneously maintain a fixed exchange rate, free capital flows and a separate and independent monetary policy.

According to the famous theory, governments of "open" economies face an economic "trilemma" that "forces to resign" at least to one objective of economic policy. If they want to "enjoy" free flow of capital (1), they must sacrifice the exchange rate policy of its currency (2) or give up to its own monetary policy (3). Ie they will only enjoy an autonomous monetary policy if they let the exchange rate float.

That is, to give up a political control over the movements of transnational capital (open economy) implies, "for reasons of economic theory", to give up an autonomous exchange rates policy (currency devaluation for exemple ) or an independent monetary policy (lower interest rates). The give up of a certain economic policy for the benefit of the population would not be at all a cut of national democracy but a whimsical imponderable of economic theory.

In practice, as has recently statetdhe economist Hélène Rey, the global financial cycle restricts monetary policies whatever the exchange rate regime. "Many believe that a flexible exchange rate can isolate ourselves from financial shocks and allow us to pursue an independent monetary policy ... But if there is a global financial cycle, as I think, the exchange rate can not separate us from what happens in the rest countries "(Finance and Development. June 2015). That is, if you want to continue "enjoying" the free flow of capital, so dear to monopoly transnational capital, you will have to give up any autonomous economic policy at all. That is, the free flow of transnational monopoly capital imposes a kind of straitjacket that prevents any democratic reaction to Monopolistic Depression.

In addition, monopolists and financiers have imposed on the world a kind of "solidarity market". In the absence of capital controls and trade protectionism, and with most industries offshored , economic stimulus in some countries end up benefiting exports of others. In the Chinese case the beneficiaries have been Latin America and sub-Saharan Africa, the so-called emerging countries that managed to decouple for a few years of the Monopolistic Depression.

It is precisely the quasi constitutional institutionalization of free mobility of transnational capital registered in bilateral agreements, regional agreements, integration agreements, or macro global agreements (TTIP, TPP), which is preventing the nations to resist the onslaught of the Great Monopolistic Depression.

Even the giant Chinese nation, with huge dollar reserves, is experiencing that to continue "enjoying the free flow of capital" implies few if any autonomy in terms of policy exchange or alternative monetary policy to boost domestic demand. China will must, therefore, die insisting on the export model that will dictate transnational monopolies, polluting without restraint, squandering its resources, cutting wages and increasing the number of unemployed.

So triumphant monopoly capitalism, with little opposition can finally show his true face, its intrinsic essence is to maintain human society in a permanent state of economic and environmental crisis to further increase their power and profits at any cost even if it means ending the human experience on the planet.

Links:

http://blogs.lclark.edu/hart-landsberg/2015/07/26/capitalism-at-work-profits-over-people/

http://blogs.lclark.edu/hart-landsberg/2015/08/03/signs-of-global-slowdown/

http://isj.org.uk/the-global-crawl-continues/

No comments:

Post a Comment